Hidden and Unexpected Costs When Purchasing A Home

Your home is probably the most expensive thing you’ll ever own, and that expense goes beyond the closing price. There’s the cost of the house, but then there are other ongoing and upfront expenses that can catch you off guard. Especially if you’re a first time buyer, it helps to know what you’re getting into.

Zillow estimates that, on average, Americans pay about $9,000 a year in extra home ownership costs, but that varies depending on where you live, and how you buy. Some of these costs aren’t exactly “hidden” but they are commonly overlooked. Let’s take a look at them in detail.

Home Inspections

You put an offer on a home, and it got accepted. Hooray! From here, inspections will be your first major expense. Yes, there may be more than one inspection.

Before you officially close on your house, you’ll want to schedule a thorough inspection. In fact, your lender will probably even require one. At a minimum, you want to order a general inspection of the house and an inspection for wood-destroying insects (also known as termites), if that’s not included in the general. A general inspection will run you a few hundred bucks, and a termite will probably be around a hundred. Depending on the age and condition of the house, you may also want to schedule a sewer inspection, which can be another couple hundred dollars.

All of these can add up to over a thousand dollars, but that’s a small price to pay to make sure you’re not getting a lemon. If the house requires a hefty amount of maintenance, you might renegotiate with the seller, pull out of the deal completely, or simply budget for the added expense.

In some states, if a previous buyer backed out but they conducted a home inspection, the seller is required to disclose that inspection. In this case, if your mortgage lender doesn’t require you to conduct your own, there’s nothing stopping you from skipping the inspection altogether. You already have a report, after all. However, it’s always a good idea to get your own inspection anyway. It’s a big purchase, so it’s better to err on the side of caution. Plus, you want to be around during the inspection to see things for yourself.

In some cases, lenders require survey costs, too. That can be another few hundred bucks, but you’ll get a professional survey of your property so you know exactly where your boundaries are.

Closing Costs

After your offer is accepted, your lender will crunch some numbers and run the paperwork. At this point, they should give you a detailed list of what your closing costs are. According to Zillow, closing costs will run you an extra 2% to 5% of the home purchase price. So if you’re buying a $200,000 home, expect to spend between $4,000 and $10,000. Here’s what these costs usually include:

- Lender fees: These include everything from administrative costs to wire transfer fees to fees for pulling your credit report.

- Appraisal: The home appraisal can be a big expense, at several hundred dollars. The lender wants to make sure the home appraises for the sale price.

- Title or attorney fees: Government filing fees, escrow fees, notary fees, and any other expenses associated with transferring the deed over to you.

- Escrow fees: You might be required to pay some of your property taxes and insurance into an escrow account upfront.

- Interest: You’ll have to pay interest that’s prorated from the date of your closing to the first of the following month.

You can always plug some numbers into a closing cost calculator to get a bit more specific idea of what you’ll pay, but in general, expect to spend several thousand dollars on top of your down payment when you close on your home.

Budget for Ongoing Taxes and Insurance

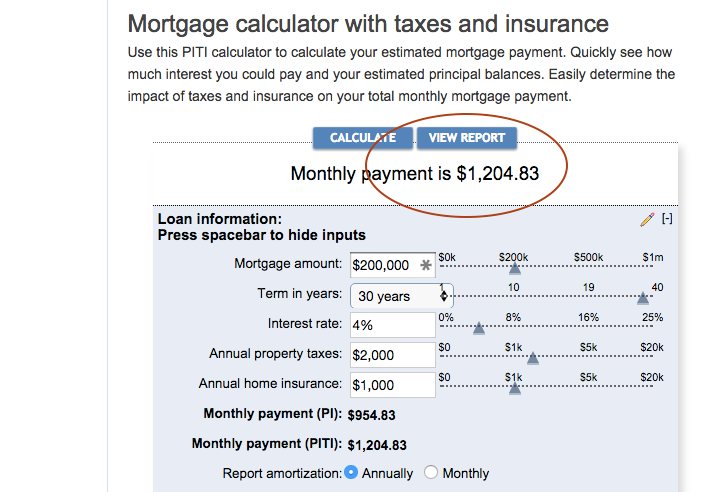

Monthly mortgage calculators tell you what your mortgage payment, including interest, will be each month. They don’t always include the taxes and insurance, though, and that adds up. For example, if you have a $200,000 mortgage at 4% interest over thirty years, your mortgage and interest will be $954. Not too bad. But calculate your total monthly mortgage principal, interest, taxes, and insurance. (PITI), and here’s what your payments look like:

When calculating your monthly mortgage payment, include the cost of interest, taxes, and insurance (PITI).

That’s quite the jump! It doesn’t even include mortgage insurance, which you generally have to pay if your down payment is less than 20 percent. That can range from 0.5% to 1% of the cost of your loan.

Of course, your taxes will vary depending on the value of your home and where you live, but WalletHub reports that the average U.S. homeowner pays about $2,000 a year. It’s about $1,000 for homeowner’s insurance, but again, that varies quite a bit.

Depending on the terms of your loan, you might pay this monthly into an escrow account (also known as an impound account). In this case, you make these payments to your lender, and they’ll pay your taxes and insurance on your behalf. If you don’t have an escrow account, you’ll just pay them on your own directly when they’re due.

However and whatever you pay, make sure to budget for this ongoing, recurring cost. There’s good news, though: you can deduct your property tax and mortgage interest from your taxable income, so you’ll pay a less in taxes every year.

Keep Funds On Hand for Maintenance and Repair

When your air conditioning craps out as a renter, it’s a pain, but all you have to do is call your landlord and hope for the best. As a homeowner, it hurts a little more because you have to pay for for the repair yourself.

Most people know owning your own home means forking over the cash for your own maintenance, but you might underestimate how much these projects will run you. Jammed disposals, leaky faucets, and cracked exterior paint are just a few repair projects that catch most first-time homeowners off guard.

Every home is different, so there’s no one-size-fits-all answer for determining how much you’re going to pay on maintenance every year. However, here’s what one financial planner told The New York Times, based on his own experience with clients:

Mr. Stearns estimates that owners of a newer home that do some work for themselves but contract major work out to others will pay 3.6 percent of the original purchase price annually for maintenance and 4.5 percent if it’s an older home.

Other sources put that number as low as one percent. When dealing with money, it’s almost always a good idea to err on the side of caution though, so it can’t hurt to have about four percent of the purchase price budgeted for repairs each year. For a $200,000 home, that’s about $8,000. It seems like a lot, but even if you don’t spend that money, consider it an emergency fund for your home.

Prepare for Higher Utility Bills

Let’s say you moved out of your cramped apartment and into a nice, three-bedroom home. Elbow room is great, but it also means your bills will be a little higher.

Depending on what you’re used to paying, your gas, electric, and water bills won’t necessarily be higher when you buy a home, but they often are. Plus, your landlord might foot the bill for some expenses (like trash pickup or water) that you’ll have to pay when you own. According to the latest data from the U.S. Census, homeowners pay a couple of thousand dollars extra on utilities every year, compared with renters. Continue reading > > >

via LifeHacker

No Comments